When you are looking for yet another household, its likely that that you may need financing to assist pay for it. Plus in one search, you have see several different types of funds: mortgage loans and you can build funds. As they one another shelter the costs having an alternative family, they do differ in a lot of elements such as:

Construction funds want an in depth bundle along with the length of time it does get, how much cash you are able to purchase, bargain into the builder, and projected assessment quantity of the complete family

- What type of properties one can use them to own

- Once you receive the funding

- Rewards attacks

I protection this type of differences and gives details to the a property loan vs home financing away from Indiana Players Credit Partnership (IMCU) during the this blog you can try here.

A housing mortgage is the one that you use to fund property youre strengthening. That money can go with the checks, materials, belongings, builders, and you will whatever else you should complete the investment. Mortgages pay only to possess homes one currently exist. And if you are wanting strengthening your upcoming family, you will need to choose a construction mortgage. Each other brands can be used when you’re incorporating on to a current home.

Since these a couple funds disagree on domiciles they shelter, they also differ when you look at the if you possibly could use that cash, standards to receive all of them, and exactly how much time they past. Let us look closer at every difference in a homes mortgage and you will home financing:

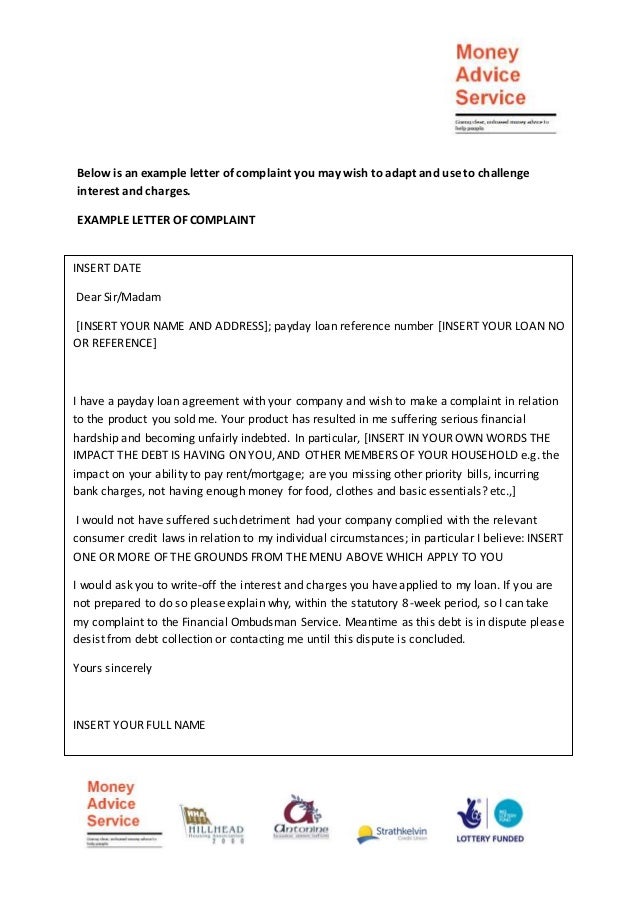

Framework financing want a detailed plan plus just how long it can need, simply how much possible purchase, package into the creator, and you may projected assessment amount of this new done home

- Whenever you utilize the money: When taking away a home loan, an entire amount of the loan try applied at closure. Yet not, just a little bit of a housing loan is applied at the a period. That’s because the lender will want to ensure that the newest build in your home is going given that prepared. You can acquire a fraction of your loan at first of each stage of your strengthening procedure. After for each and every stage, an inspector need certainly to come out to check advances one which just remain strengthening.

- Collateral: With an interest rate, your property will act as collateral. If you’re unable to pay off your own home loan, your lender takes your house. Having framework finance at the same time, you do not have to incorporate people major guarantee.

- Interest levels: Structure financing rates is greater than men and women to have mortgage loans because you dont render equity having build funds. That have design financing, you merely have to pay attention in the create of one’s domestic. Then you definitely afford the left balance once your home is accomplished. You could shell out it in the form of dollars or a good antique home loan. Which have a housing-to-long lasting loan, it does immediately turn out to be a mortgage. You only pay both desire as well as for the main mortgage itself every month for those who have a home loan.

- Advance payment: Build finance tend to want a more impressive advance payment than mortgage loans simply because they do not require equity. You to definitely number is generally 20-30% of your own strengthening speed whereas the loan down-payment amount is also start around 3-20% of your house’s value.

- Duration: A casing loan typically only persists one year. That is because they merely pays for the building of the house alone, that needs to be finished in per year. You want a mortgage once your property is entirely situated. Which have one type of design loan, you have to get home financing individually. For the different kind, a casing-to-permanent loan, the structure loan will instantly changeover towards a mortgage as soon as your home is complete. Mortgages just take much longer than simply framework funds to repay. They will take you fifteen-three decades to do so.

Framework finance require reveal package and just how long it can capture, how much you can spend, bargain to your builder, and estimated appraisal number of the done domestic

- A credit history regarding 680 or more

To order a house is a vital step to produce a lives for your self. During the Indiana Users Credit, we want you to definitely discover domestic you have always wanted. That is why you will find each other build loans and mortgages to possess any type of one fantasy ends up.

In the Indiana Participants Borrowing from the bank Union, we require at least FICO credit rating to own a casing financing off 680. With the help of our structure to permanent loan, you can expect:

If you find yourself prepared to buy a property and want to get it done which have a lender exactly who cares about you and you can the community, here are some the construction loan choices otherwise their financial solutions towards the all of our webpages.